While modeling, analysts find themselves hesitant whether to use impressions, spend, or clicks metrics to model the impact of their ads.

At MASS Analytics, our approach is to look at all the available metrics and use the most appropriate one for each channel, bearing in mind the questions the client wants to answer.

The logic behind this is to select the metric that better captures audience engagement. The most important thing to remember in MMM is that every single channel serves a purpose. And a channel within a certain media mix could serve a very different purpose for each company.

You must always start with understanding the business objectives. Make sure to ask your marketing vis-à-vis: When you put that channel in your mix, what was the end in mind that you wanted to achieve from that channel?

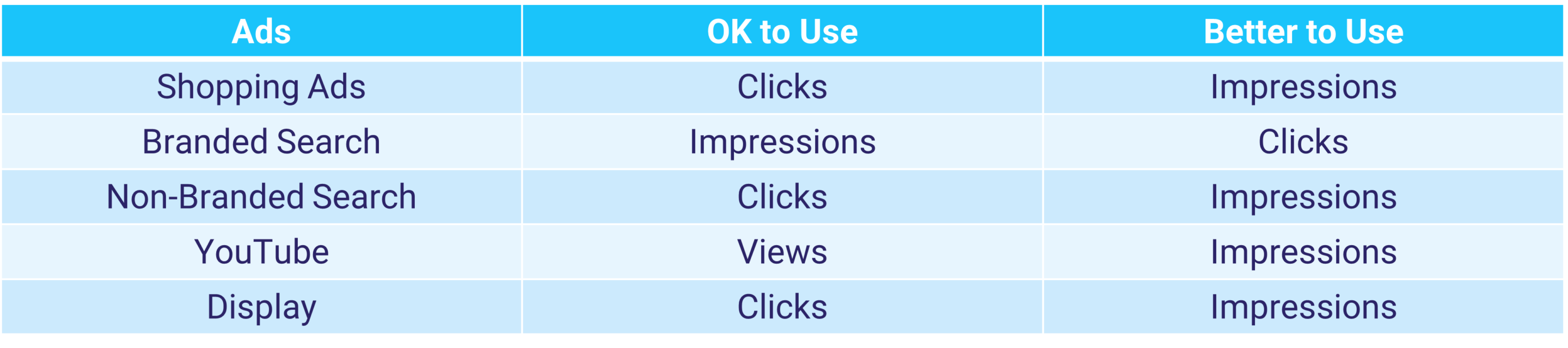

A typical example for this would be Search. If the data allows it and we have a breakdown by type (branded and non-branded search) we tend to generally use click variables for the branded part and impressions for the generic one. Here’s some more examples for Google channels:

Table 1: Examples of metrics to use for select channels (based on our experience)

Why Not Use Spend as the Metric for All Channels?

In many cases, using spend exclusively works. It’s simple, it’s easy, and it gets the job done. It’s the common denominator for all channels after all. Why should I go through the complication of using another metric when spend works perfectly fine?

But we all know that easier doesn’t necessarily mean better.

In other settings, spend data alone doesn’t tell us the full picture. And that’s when we have to dig deeper to get the answers we’re looking for. As a rule of thumb, do not consider spend when other metrics are available. This is because spend is impacted by the variation of the CPM and is not always accurate when it comes to estimating variations in true exposure.

Example: Modeling Impressions vs. Spend

You notice that the budget for Meta has increased by 20% YoY.

Does this +20% translate into a 20% increase in impressions/clicks/views? If it doesn’t, that means I will see in my variable that there has been an increase in the activity on Meta.

But does this really mean that I have reached more people?

If we measure using impressions, we know that this spend did not translate in an increased number of exposures.

It’s the same number of exposures. Why would you expect more sales? You wouldn’t.

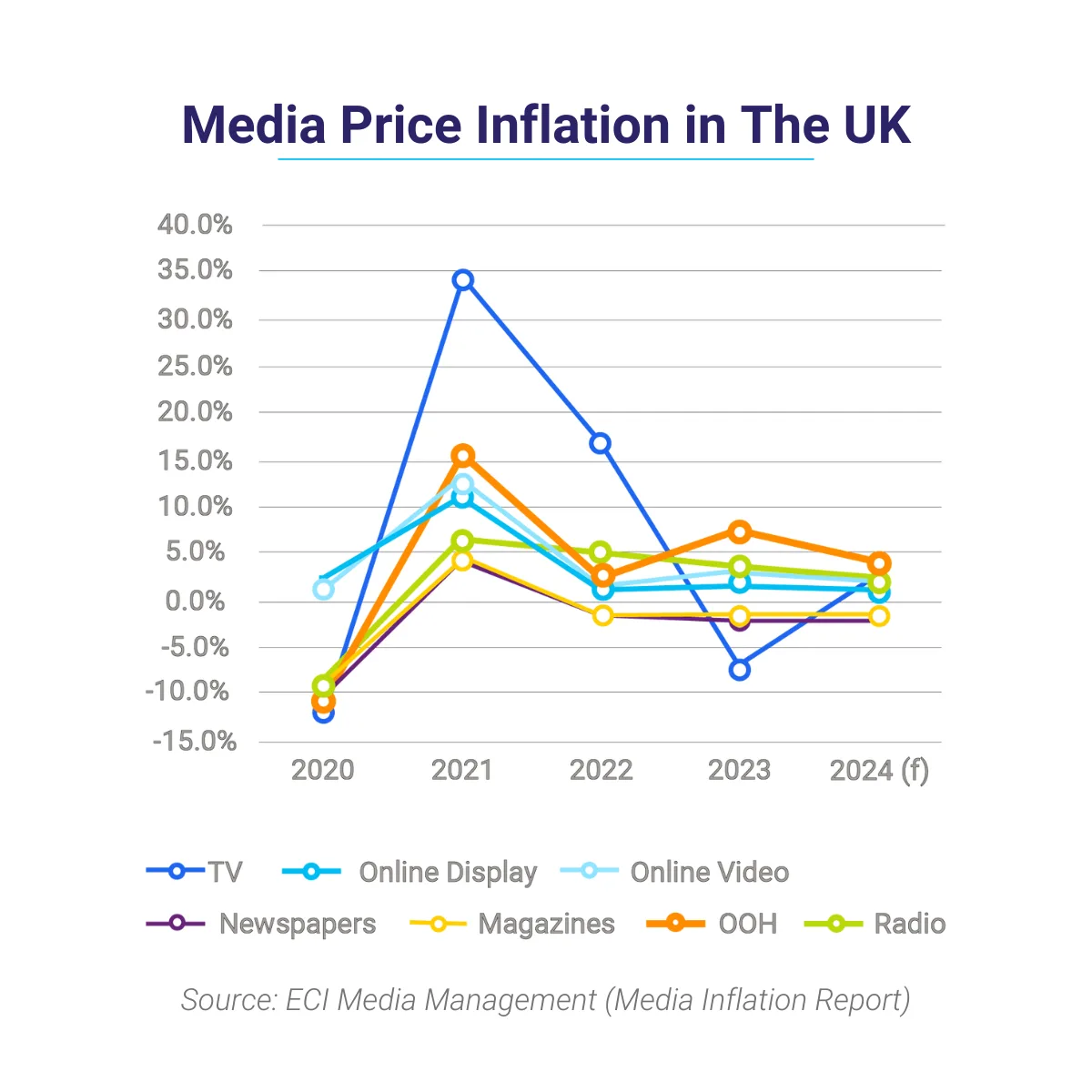

But if you use spend in this context, you would be expecting your model to pick up an increase in sales, but it doesn’t. This is an important consideration, especially in the last year where we have seen a lot of media inflation. Not to mention CPM fluctuations from seasonality.

Media price inflation has fluctuated significantly for major channels, according to ECI Media Management

(Media Inflation Report). If you use spend in channels impacted by this, your measurement will be less accurate.

Similarly, there’s also cases where spend increases because of changes in the execution.

For example, if we have invested in a different audience that is harder to acquire and therefore more expensive. If you made a deliberate shift to a higher-quality inventory, then you should model that as a separate variable so that you can try to work out whether the shift in strategy was worth it.

So, we need to know why. Because with this information, we can then create different versions of our variable to assess whether that increase in spend is justified.

Conclusion

Our advice to modelers is to take all the data for all the metrics related to a channel (impressions, clicks, views, spends) and understand what that channel was meant to do. Understand the story behind deploying spend on that channel and see which one is better.