In this article, we will explore the essential metrics used in Marketing Mix Modeling and how they contribute to shaping effective marketing strategies. We will explore key concepts such as Contribution, Waterfall Charts, Revenue, Return on Investment (ROI), Effectiveness, Efficiency, Diminishing Returns, Marginal Returns, and the Optimal Execution Range. Understanding these metrics will enable marketers to make data-driven decisions, optimize their marketing spend, and maximize their revenue growth.

So, let’s dive into the world of Marketing Mix Modeling and uncover the important metrics that can drive marketing success in an increasingly competitive business landscape.

Contribution

Contribution is the impact that a specific factor has on your KPI. It could be expressed in absolute terms or as a percentage of total sales.

How is Contribution useful in MMM?

Say you are modeling sales units and you measured that the contribution of paid search is 22,600 units. It means that thanks to the search activity that you have invested in, you sold an additional/incremental 22,600 units.

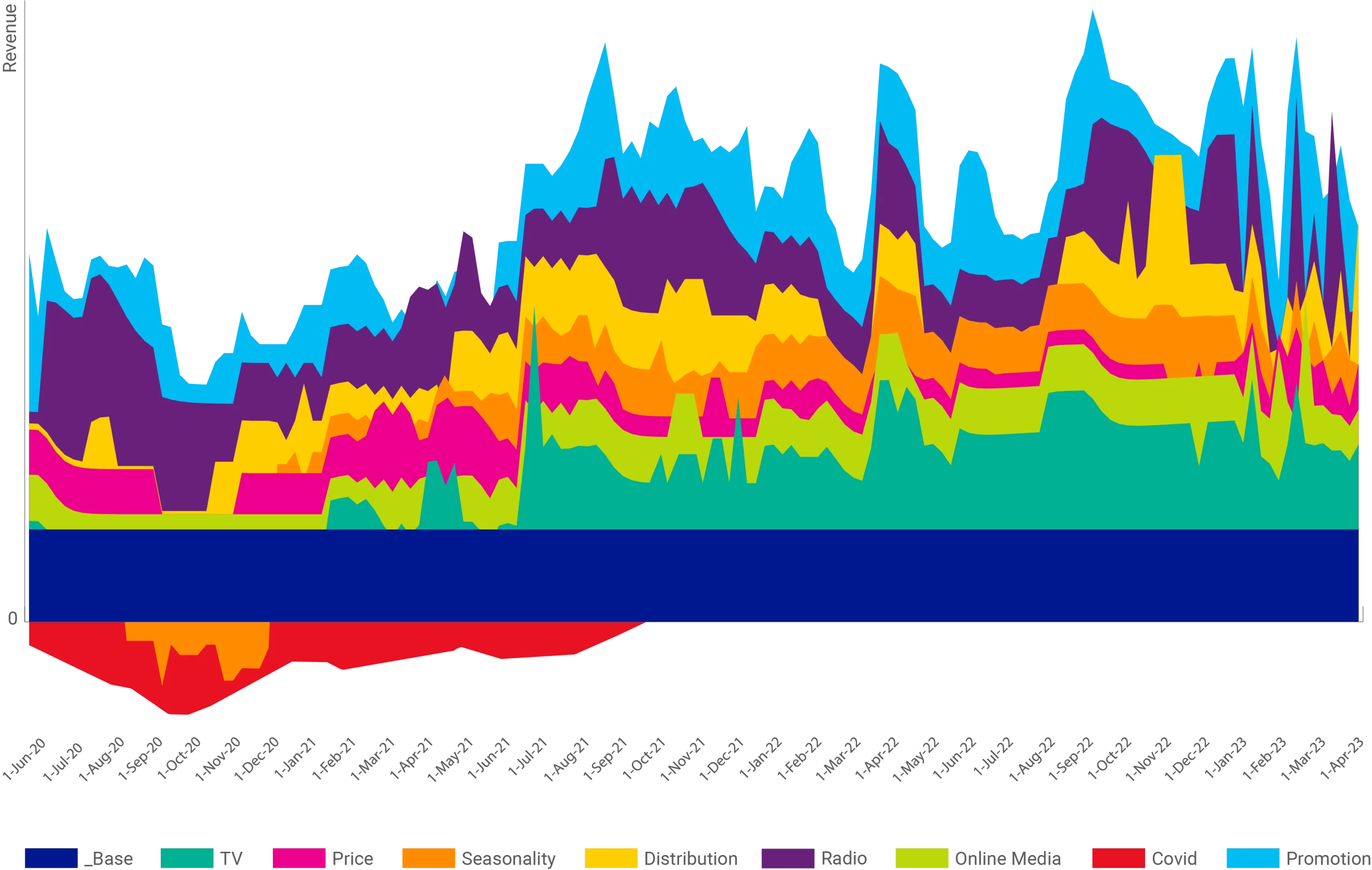

Contribution is also useful when creating the Contribution Chart (see Figure 1).

It is a chart where you see the contribution of every single factor. If you sum up all the contributions and add to this the residuals, you will obtain your total sales.

Figure 3

Waterfall Charts

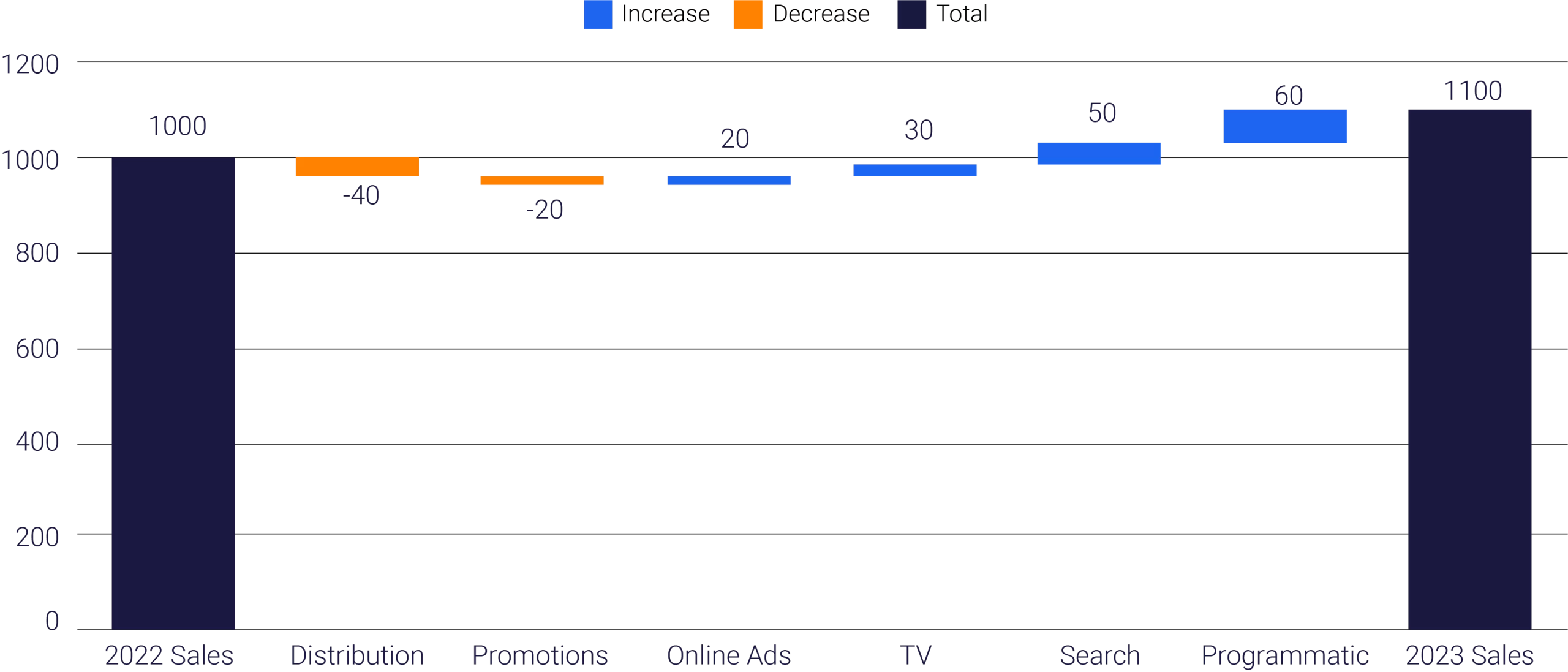

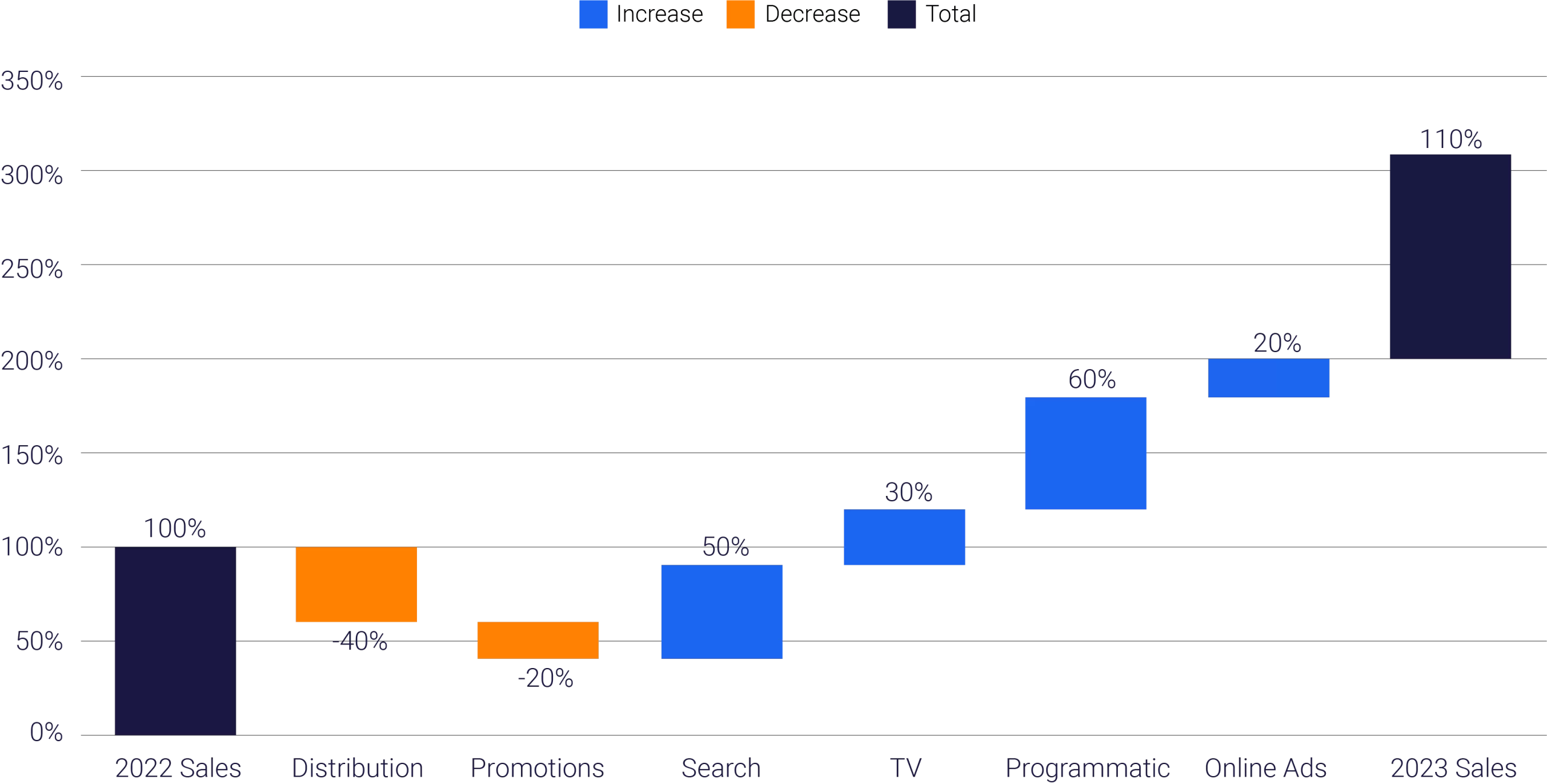

Another useful chart linked to the concept of contribution is the Waterfall Chart. They are very important when it comes to understanding your marketing activities period on period. Usually, they’re used to highlight the factors responsible for the year-on-year revenue change.

Example:

We have recorded 1,000 units of sales in 2022. In 2023, sales have increased to 1,100 units.

⇒10% increase in sales in terms of units between 2023 and 2022. What has driven this difference? That’s exactly the type of answer that you can get from a Waterfall Chart (see Figure2):

Figure 2: The Waterfall Chart

As the chart indicates:

- 5 Search has contributed to an increase of 50 units between 2022 and 2023.

- We lost 40 units to distribution and 20 units to promotions.

→ If we add all those up, we’ll obtain exactly 100, which is the YoY increase in sales.

Tip: Waterfall Charts can also be expressed in terms of percentages (see Figure 3). All you need to do is take that absolute difference and divide it by the sales of the previous period. Note that by adding up all those percentages, you should always obtain the total growth percentage.

Figure 3 : The Waterfall Chart in %

Revenue

Assume that we have built a model where we have modeled the impact of media spend on unit sales, i.e. incremental contribution.

What we want to do next is convert those unit sales into incremental revenue. Here, there are different options available. The Simplest one is to take the average price over the fitted period and multiply it by the incremental contribution to obtain a proxy of the incremental revenue. If you have more detailed data like weekly prices, you can use this granularity to convert your weekly contribution into weekly revenue and then sum it all up.

Not really! For certain verticals, like Telcos, Banking, or Insurance, etc., price has a different definition. In these verticals, when you acquire a customer, not only will you generate immediate revenue, but you will also have renewals of the service/subscriptions and that needs to be accounted for.

That’s why it’s important to consider the Customer’s Lifetime Value. Generally, it is externally computed. So you’d probably request it from your client. You can also have it computed internally if you are performing in-house MMM.

Revenue = Customer Lifetime Value × Incremental Contribution

Return On Investment (ROI)

ROI is simply the ratio between your incremental Revenue and Spend. The role of ROI is to help you understand the difference in performance between different media channels. It will tell you how much contribution each dollar invested in a particular channel gives back.

It’s important that both components be expressed in terms of value. In most cases, when we model Digital, we use impressions, or when we model offline, we use GRPs. So there is a need here to convert those GRPs or impressions into spend. And that’s what goes into the denominator. Sometimes we model unit sales, and here we need to convert the unit sales in terms of revenue by either multiplying by the average price or the lifetime value so that the denominator is expressed in value.

However, you need to be very careful as having a higher ROI doesn’t necessarily mean that you need to invest more into that channel because sometimes you can have a high ROI in a saturated channel, which means that you shouldn’t invest any more money on that channel as it is inefficient.

Effectiveness

This metric’s importance could be summed in the following: It isolates the impact of media inflation. How?

We have now defined ROI as a ratio between Incremental Revenue and Spend. Imagine that we have computed the ROI of Search in 2023 and 2022. As we compared the two, we saw that the ROI in 2023 is less than in 2022. Does this mean that ROI Effectiveness has dropped for Search in 2023? Not necessarily. We are aware that in 2023 there has been a lot of media inflation, which could have caused the ROI to drop. So, a drop in ROI does not necessarily mean that the channel is working less effectively. That’s exactly why we need to look at a metric that isolates the impact of media inflation, which is: media Effectiveness.

No, we must distinguish between Effectiveness of offline channels and Effectiveness of digital channels. Generally, for offline channels, we use GRP as a metric in our modeling. Computing the Effectiveness of offline media would be just looking at the ratio between incremental revenue and the number of GRPs.

Effectiveness = (Contribution/GRP) x 100

For digital channels, the way we compute Effectiveness is simply the incremental revenue divided by millions of impressions.

Effectiveness = (Contribution/Impressions) x 106

Efficiency

Efficiency is an index that assesses the contribution of a given channel relative to total media contribution. If Efficiency is higher than 1, it means that the contribution of the channel is higher than its share of spend, which is the conclusion the analyst wants to reach.

There are different ways to compute Efficiency. One of them is to look at the ratio between the percentage contribution from total media divided by the spend. This way, we’ll be computing what each dollar spent on the channel will bring us back in terms of percentage contribution from media.

Another way of computing efficiency is to look at the ratio between the percentage contribution of a channel from total media contribution divided by its percentage share in spend.

Diminishing Returns

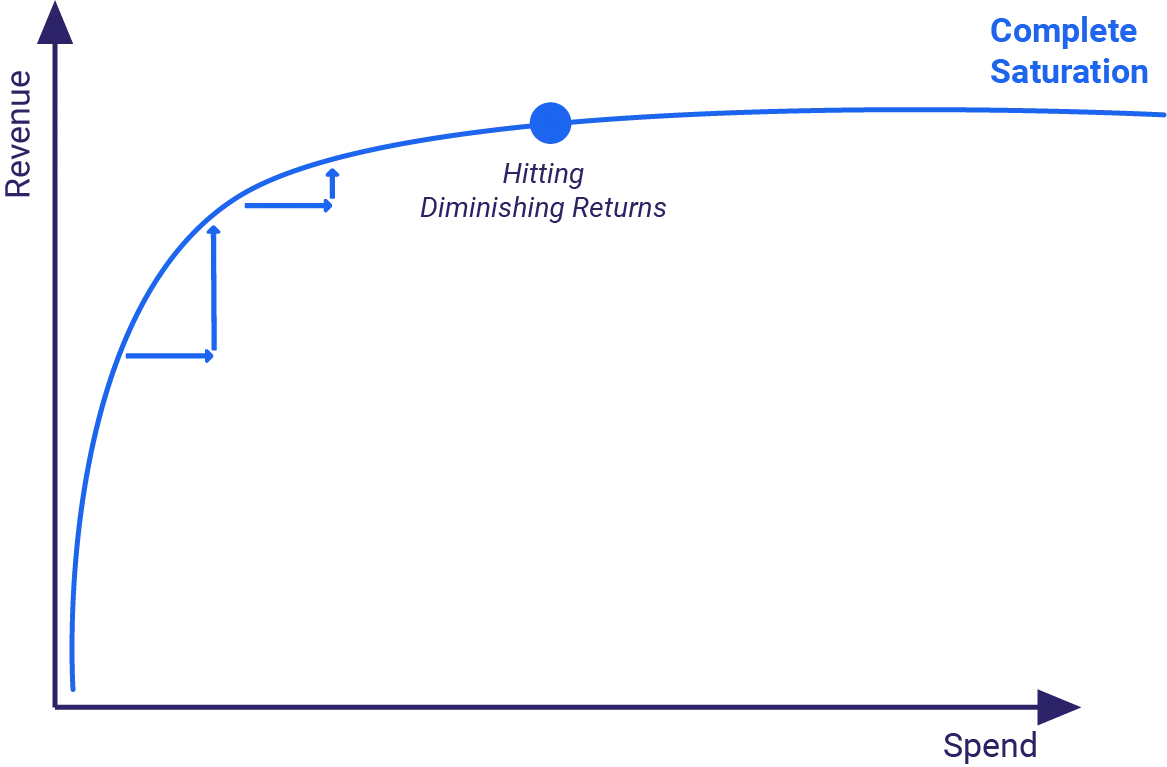

The backbone of any optimization exercise is the Diminishing Returns Curve.

It’s simply a curve that depicts the relationship between spend on a channel and the incremental revenue generated by that channel. If we divide the incremental revenue by the spend, we obtain the ROI.

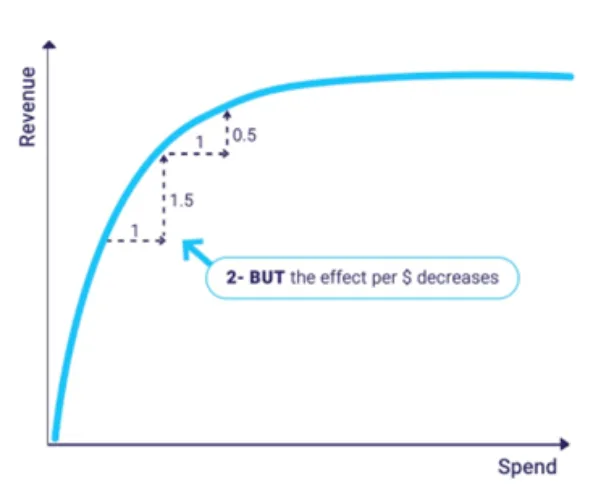

The relationship between spend and revenue is not linear, it’s concave, meaning that the more you spend on a particular channel, the more revenue you get, but at an increasingly slower pace (see Figure 4). As you approach a high level of spend, you start hitting diminishing returns and it becomes very hard to acquire additional incremental revenues.

Figure 4: The Diminishing Returns Curve

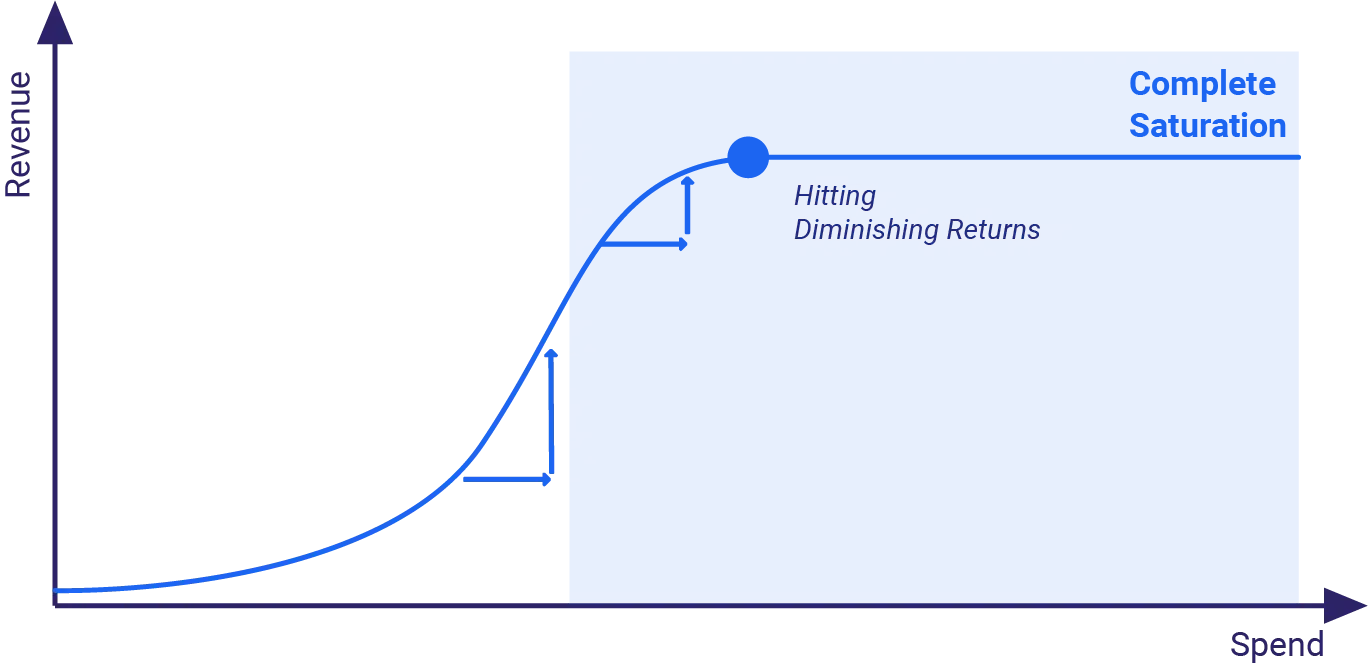

The Diminishing Returns curve is not always concave. Sometimes, it’s better to go for an S-shaped curve (see Figure 5).

In this context, you have a convex part characterized by increasing returns up to a certain point, and then you obtain a concave part where we have diminishing returns.

Figure 5: The S-shaped Curve

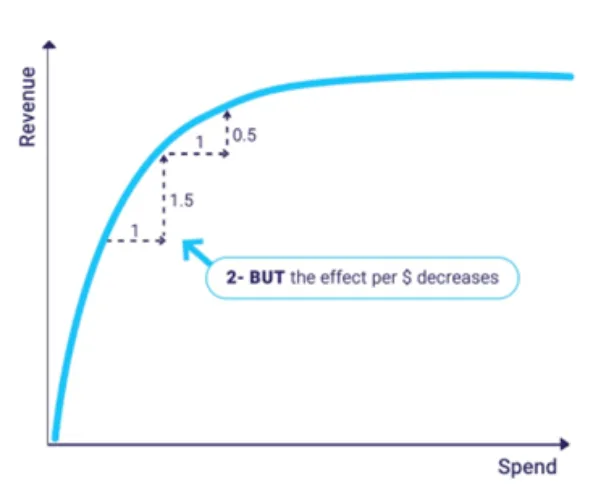

Marginal Returns

Marginal Returns simply means the additional revenue that you acquire as a result of an additional investment, e.g:

Figure 6: The Diminishing Returns Curve

First, this is a positive relationship. It means that, as we spend money, we generate more revenue. However, the additional revenue that is brought by additional spend is decreasing. One million in investment used to bring back 1.5 million in revenue (at low spend levels). That same 1 million invested later (i.e at higher spend levels) will not bring 1.5 million anymore. It will only bring 0.5 million.

First, this is a positive relationship. It means that, as we spend money, we generate more revenue. However, the additional revenue that is brought by additional spend is decreasing. One million in investment used to bring back 1.5 million in revenue (at low spend levels). That same 1 million invested later (i.e at higher spend levels) will not bring 1.5 million anymore. It will only bring 0.5 million.

Figure 6: The Diminishing Returns Curve

That’s exactly what we mean by decreasing marginal returns: the impact per dollar spent is decreasing as we move down the curve until we reach complete saturation, making it inefficient to invest in that channel because of saturation.

Optimal Execution Range

Before we dive into the details of this metric, it’s important to note that we can only obtain the Optimal Execution Range in the context of the S-shaped diminishing returns curve.

The Optimal Execution Range is a recommended range of spend for our client to invest when it comes to a particular channel. Figure 7 is a simplified illustration of how we can obtain it. If you’d like to read more about the creation of the Optimal Execution Range, check this use case out (Behind the scenes of optimization).

Figure 7: The Optimal Execution Range

Through those curves, we can devise an optimal range. The minimum boundary of the range is the maximum marginal ROI and the upper boundary of the range is the maximum ROI. However, it’s very important to think about Optimization as a holistic exercise. It’s not about the Optimal Execution Range for that channel only. You need to consider the other optimal execution ranges when you decide on where to put your money.

Conclusion

Marketing Mix Modeling (MMM) provides crucial insights into marketing performance by analyzing the impact of various factors on KPIs. Metrics like Contribution, Waterfall Charts, Revenue, ROI, Effectiveness, Efficiency, Diminishing Returns, Marginal Returns, and the Optimal Execution Range help marketers make data-driven decisions, optimize spend, and maximize revenue growth.

Understanding these metrics allows businesses to compare channel performance, isolate media inflation impact, and identify saturation points, guiding effective marketing strategies in a competitive landscape.